60 ամիս

Առավելագույն ժամկետ

10.000.000 մլն

Առավելագույնն գումար

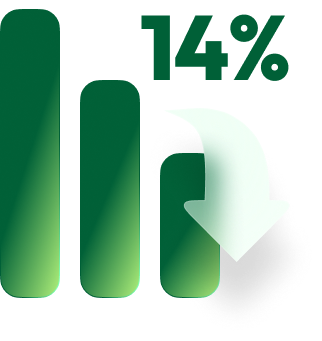

14 - 16%

Տարեկան անվանական տոկոսադրույք

14.97 - 17.26%

Տարեկան փաստացի տոկոսադրույք

Refinance in just a few simple steps

Transfer your loans

Move your loan or multiple loans from any bank, fully online, without visiting any branch

Get more funds

Receive an additional credit limit to support your new goals

Have one loan, one payment

Combine your loans into a single monthly payment with better terms

Get new benefits while refinancing

Extra funds

When refinancing, you can receive an additional consumer loan limit at a lower interest rate than the bank’s standard consumer loan rate

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Lower interest rate

By transferring loans from other banks, you can reduce the interest rate on your existing Inecobank loans

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Extended repayment period

Combine your Inecobank loans, extend the repayment term, and reduce your monthly payments

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Why refinance?

Refinancing allows you to consolidate your loans from other financial institutions into one loan, and get multiple benefits

Lower interest rates

Combine your loans and get an annual percentage rate starting from 14%

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Simple process

Refinance online with no paperwork or branch visits, and receive approval in minutes

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Higher limits

Get up to AMD 15 million with a repayment period of up to 60 months

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

Better terms

Reduce your monthly payments and manage your loan term more efficiently

How to refinance

You can combine your loans in the InecoMobile app in just a few simple steps

Open InecoMobile and check your limit

Go to the Loans section, enter the Sprint page, select refinancing, and see your available limit

Select the loans you want to combine

From your active loans list, select those you want to refinance, enter the required codes, and review the terms

Confirm your loan

Enter the one-time password and enjoy the convenience of one loan instead of many

Register for a Free Consultation

Still have questions? Enter your details and our specialists will contact you

What will you get refinancing

Add paragraph text. Click “Edit Text” to update the font, size and more. To change and reuse text themes, go to Site Styles.

What is refinance

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

When to refinance

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

How refinancing works

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

01

Better percentage

Lorem ipsum

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed sed nunc quam. Donec ultricies eu dui non condimentum. Integer eget odio convallis, maximus felis at, condimentum tellus. Proin a ligula a velit ultricies fermentum eu eget ligula. Class aptent taciti sociosqu ad litora torquent per conubia nostra, per inceptos himenaeos. Mauris aliquam,velit

02

Better percentage

Lorem ipsum

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed sed nunc quam. Donec ultricies eu dui non condimentum. Integer eget odio convallis, maximus felis at, condimentum tellus. Proin a ligula a velit ultricies fermentum eu eget ligula. Class aptent taciti sociosqu ad litora torquent per conubia nostra, per inceptos himenaeos. Mauris aliquam,velit

03

Better percentage

Lorem ipsum

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed sed nunc quam. Donec ultricies eu dui non condimentum. Integer eget odio convallis, maximus felis at, condimentum tellus. Proin a ligula a velit ultricies fermentum eu eget ligula. Class aptent taciti sociosqu ad litora torquent per conubia nostra, per inceptos himenaeos. Mauris aliquam, velit

Additional information

Yes. Refinancing allows you to combine loans from other banks with existing Inecobank loans and reduce interest rates depending on the total refinanced amount, or refinance your Inecobank loans and extend their repayment period.

The additional consumer loan limit is available when selecting loans for refinancing. It is offered automatically by the system, and the amount depends on the total volume of the refinanced loans.

15.000.000

Maximum amount

14 - 21%

Annual nominal interest rate

14.97 - 23.13%

Annual percentage rate

60 months

Maximum period

Refinancing is available to all citizens of Armenia aged 21–70 who have at least one active consumer loan with another financial institution.

The entire refinancing process is done online, without paperwork or visiting any bank. As a result, the loan amount is transferred to the account within a few minutes.

For additional inquiries, you can submit a request for a personal consultation or contact Inecobank’s customer service center at 010 510 510, or use the online chat available in the app.